Missouri drivers will soon see major changes in the way they purchase vehicles under a new state law designed to close loopholes and strengthen tax collection.

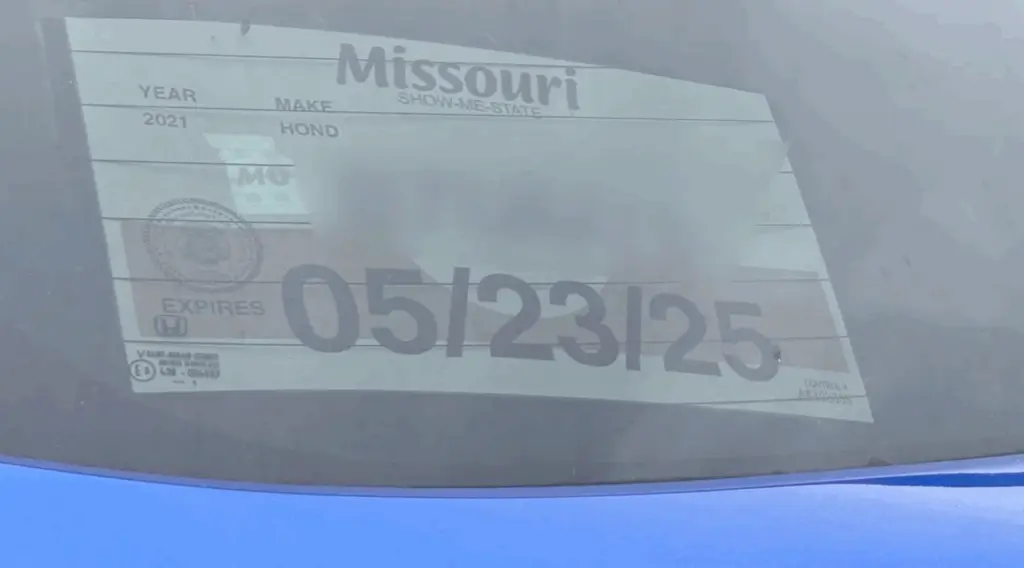

The law will require buyers to pay sales tax at the time of purchase rather than later at the license office. It will also eliminate the use of traditional temporary tags, a move officials say will simplify the registration process and cut down on expired paper tags seen on Missouri roads.

According to the Missouri Department of Revenue, millions of dollars in sales taxes have gone uncollected under the old system, where buyers could drive with temporary tags and delay paying their taxes for weeks or even months. By requiring sales tax to be collected upfront, the state expects to secure much-needed revenue for roads, bridges, and other public services.

Department of Revenue Director Trish Vincent said the change is aimed at improving fairness and accountability. “This is about making sure everyone pays their fair share and ensuring those dollars are put to work for Missouri’s communities,” Vincent explained.

The new law is expected to roll out in phases, giving dealerships and buyers time to adjust. For consumers, the biggest change will be paying the full cost—including taxes—before they leave the lot, and leaving with plates tied directly to their permanent registration rather than a temporary tag.